Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

People looking to secure contractor mortgages don`t always have to be penalised due to the nature of their work.

For a free no obligation quotation, speak confidentially to our in house adviser team on 0800 298 3000 (free from a landline) or 0333 003 1505 (mobile friendly), alternatively fill in our shorton line enquiry form and we will call you. Due to our experience we understand the self employed mortgage marke and have access to many well known and specialist lenders who have products for contractors and sub contractors. Add to that we have been helping contractors find mortgages and remortgages for around 25 years and you can see why it might well be worth your while checking us out.

For a free no obligation quotation, speak confidentially to our in house adviser team on 0800 298 3000 (free from a landline) or 0333 003 1505 (mobile friendly), alternatively fill in our shorton line enquiry form and we will call you. Due to our experience we understand the self employed mortgage marke and have access to many well known and specialist lenders who have products for contractors and sub contractors. Add to that we have been helping contractors find mortgages and remortgages for around 25 years and you can see why it might well be worth your while checking us out.What Is A Contractor Mortgage?

Put simply, a contractor mortgage is a mortgage for somebody that is employed through contract work or sub contract work and are generally considered self employed. As for the mortgages that contract workers can secure we need to clear a few things up, when it comes to pricing contractor mortgages are actually no different than any other mortgage. Unlike say Buy to Let mortgages the cost of the contractor mortgage should be no different than an employed person looking to remortgage for example. The difference comes when the lender is addressing the initial application.

The difference means that the lenders will not always use traditional underwriting. What that means is that the lender can ask for extra requirements, like the evidence of continuity in your contract work for example. Or that they can assess the application on a case by case basis and ask for documentation depending on a specific case. So although the guy next door who is also a contract worker, didn`t supply a particular document when he was securing his mortgage it doesn`t mean that you will not have to. The world of contractor mortgages can be a confusing one at times which is why you should look to an experienced mortgage broker like ourselves to take out all of the unnecessary hassle and present your case in a way that the lender will understand.

Do I Qualify for a Contractor Mortgage?

As we have explained earlier contractor mortgages are mortgages for people in a specific situation. As a result they need to have specific requirements in order to get one.Some of the main criteria includes:

- There must be a current contract in place

- Continuity must be provable in similar work

Some other things to consider:

- Borrowers new to contract work are still eligible

- Income can be defined by the annualised contract rate

What Contractor Mortgages Are Available To Me?

Let us first break this down in to two parts.Who provides contractor mortgages?

Not all lenders on the market are willing to lend to contract workers but all is not lost. There are many lenders on the market more than happy to lend on the right case even many high street ones. We have frequently secured great deals on contractor mortgages with high street lenders like Abbey and Halifax with some of the best rates currently out there on the market.

What rate can I secure?

The good news on this one is that once you have been accepted through the application process the rate you have access to will be no different from your counterparts. It is not like self certified mortgages and the high rates they commanded. If you have been accepted by the lender they can see that you have valid proof of income like anyone else and shouldn`t then be punished with high rates.

Our expert mortgage advisers help to present the ideal application for contract workers. If you are looking for a contractor mortgage then fill in our online application forms and an advisor can get back to you to talk you through the best way to secure you the mortgage that you need.

Contractor Mortgages Calculator

We understand that as a contract worker it is vital to manage your monthly living costs. We can help you out on this one. If you head over to our mortgage repayment calculator you can figure out what these contractor mortgages may cost you and budget your expenses accordingly.Compare our Contractor Mortgage Plans

Video transcript

The government`s Small Business Survey 2012 indicated that there were more than 800,000 one-person limited companies in the UK, which shows that there could be growing thirst for contractor mortgages.The Department for Business, Innovation & Skills` report suggests that numbers are higher than previously thought, as more people decide to go it alone and look to maximise their earnings by taking on contract work, rather than staying at the same company for years.

While contractors may typically get paid more than staff, they can have problems when they`re looking to borrow money, as many traditional lenders may be concerned that they not be able to meet repayments if they are between contracts for any significant period of time.

If you`re a contractor and want help to finds self employed loans and mortgages, First Choice Finance may be able to help. We`re an established finance broker that has multiple lending solutions for all types of employment status, so we have a good chance of identifying deals that will be suitable for your individual situation.

To take out a contractor mortgage with our help, all you need to do to start with is fill in our short online form or give us a call, we will then contact you and get the details we need to pick out an offer and provide it to you on a no-obligation basis. That means that if you`re not happy with the terms, you can simply walk away.

However, if you`re happy with the contractor mortgage provided, we can get working on releasing the money to you as quickly as possible. Find out more at firstchoicefinance.co.uk, call us from a landline on 0800 298 3000 or from a mobile on 0333 003 1505.

Return to the video homepage

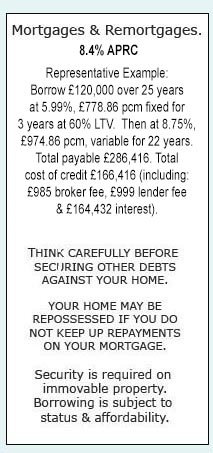

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential